FINRA expungement rule changes are officially coming. FINRA expungement refers to the process brokers may undertake to seek removal of customer complaint information from their BrokerCheck records under FINRA Rule 2080. Recently, we wrote about imminent changes to the FINRA expungement rules, and argued that these changes may not impact the expungement success rate.

But FINRA finally crossed the last hurdle to the rule change process when the SEC recently approved the proposed FINRA rule changes.

This post supplies a summary of the key FINRA rule changes, and how these changes will make the expungement process more complicated and potentially more difficult to remove client grievances from a financial advisor’s publicly available record.

FINRA has yet to confirm when the new expungement rules will take effect.

Preliminarily, even though the SEC has formally approved the changes, FINRA has not said when the rules will take effect. But it is only a matter of time. In the interim, financial advisors should understand what is coming.

Brokers who want to attempt to clean their BrokerCheck records under the current rules ought act soon.

Preliminarily, though we have argued that the expungement rule changes will not change the expungement success rate (a position subject to debate), the new FINRA rules will undoubtedly make the process more onerous. Additionally, the FINRA rules changes will place stringent time limitations on when brokers may pursue removal of a customer complaint from their CRD records. The information from the CRD comes as a result of broker-dealer and financial advisor reporting obligations under FINRA rule 4530. These obligations are often satisfied through filing the U4 Form and/or Form U5. That rule details the specifics of what written customer complaint information must be reported to FINRA.

Therefore, financial advisors who have contemplated pursuing expungement of customer complaint information from their BrokerCheck records ought to do so before the new rules take effect. Contact us for more information and an assessment of your situation.

Below is a summary of the impending FINRA rules changes.

Distinguishing expungement requests made during an investor-initiated FINRA arbitration, from “straight-in” requests.

Before brokers can understand the nuances of the changes, they must understand the distinction between the two, predominant situations where advisors may make expungement requests. They are: (1) expungement requests made during a customer arbitration; or (2) expungement sought through “straight-in” requests.”

The changes to the process will affect each.

What are expungement requests that occur “during a FINRA arbitration?”

If a customer files a formal FINRA arbitration claim that results in a disclosure on a financial advisor’s record, the current rules supply a mechanism to make an expungement request during that arbitration claim.

FINRA arbitration claims that typically trigger BrokerCheck disclosure include investor claims involving the following types of misconduct:

- Improper Asset Allocation;

- Breach of Fiduciary Duty;

- Churning and Excessive Trading;

- Failure to Supervise;

- Securities Fraud;

- Selling Away;

- Investment Suitability

- Unauthorized Trading;

- Financial Abuse

What are “straight-in” requests?

A “straight-in” request is an independent FINRA arbitration claim devoted only to removing a client grievance from a broker’s record. In these situations, the financial advisor seeking complaint removal is the claimant, and the firm that disclosed the complaint on their record is the respondent. FINRA processes “straight-in” requests under the Industry Code of arbitration procedure as opposes to the Customer Code. The Industry Code governs disputes involving members of the securities industry. The Customer Code governs disputes involving customers of the securities industry.

What are the key FINRA expungement rule changes for requests made during an investor-initiated FINRA arbitration?

The changes to the process as it relates to requests made during an investor-initiated arbitration are impactful, though not extensive.

How does FINRA process requests that occur “during a FINRA arbitration” under the current rules?

Under the current process, a broker (even if she is unnamed in the arbitration), may (without formally intervening) inform the arbitration panel deciding a FINRA arbitration involving a customer of her intent to pursue expungement. If the investor settles the case, the broker may then request to “hold the panel” to hear her expungement case.

Assuming the case goes to formal arbitration under the current rules, the arbitration panel may rule on any corresponding expungement request when it gives its arbitration award.

How will FINRA process requests that occur, “during a FINRA arbitration” under the FINRA expungeement rule changes?

Under the FINRA expungement rule changes, if the underlying case settles, the financial advisor who requests expungement may not request to “hold the panel” to hear why it should award removal of the customer complaint from the broker’s record. Instead, she would have to pursue expungement under the new FINRA rules attributable to “straight-in” requests (described in more detail below).

The panel in a customer-initiated case, must only hear expungement requests if: (1) the broker requests it; and (2) the case goes to a formal arbitration hearing, which would then require the panel to include an expungement decision as part of the arbitration award.

Notably, if the investor names the financial advisor as a party to the underlying lawsuit, the broker must request expungement as part of his defense or lose his opportunity to pursue expungement in the future. For strategic reasons, however, investors rarely name brokers as parties to FINRA arbitrations. Nevertheless, this change is significant.

Given that most cases settle, most brokers who take steps to request expungement during a pending customer case will wind up pursuing removal of the complaint through the new “straight-in” procedure.

What are the key FINRA expungement rule changes to “straight-in” expungement requests?

The brunt of the changes will apply to “straight-in” expungement requests as opposed to expungement requests during a FINRA arbitration. Most requests to remove customer complaint information from a financial advisor’s record come through “straight-in” requests. Meaning, brokers start a separate arbitration requesting removal of the disclosure. The panel decides no other issues.

For a detailed discussion on how “straight-in” requests work under the current rules, read our Primer on FINRA Expungement. Below is a list of significant changes that the new FINRA rules will bring.

Key FINRA Expungement Rule Change 1– FINRA will no longer allow brokers to participate in the arbitrator selection process.

Arbitrators serve as the judge, jury, and executioner in deciding whether to remove a client grievance from a financial advisor’s record. Under the current system, FINRA provides financial advisors in “straight-in” requests (like all other claimants in a FINRA case) with the ability to rank a roster of potential arbitrators.

Under the FINRA rule changes, FINRA will cut the arbitrator ranking process altogether. Instead, FINRA will randomly select three arbitrators from a special roster tasked with hearing the case. These arbitrators will have to meet the following criteria:

- The arbitrator must be eligible to function as a chairperson. The chairperson is the lead arbitrator. For that reason, they have more qualifications over and above other, non-chairperson-qualified arbitrators.

- The arbitrator must have completed enhanced expungement rule training.

- The arbitrator must have served as an arbitrator through an award in at least four customer arbitrations.

Why it matters.

Arbitrator ranking enables the broker to review the backgrounds and award histories of prospective arbitrators to decide which they prefer. It also enables the broker to strike or rank low the arbitrators they do not prefer.

For example, suppose a potential arbitrator’s background suggests a bias against the brokers’ interests. Under the current system, the financial advisor may choose to use one of their “strikes” to drop that potential arbitrator without cause.

The new rules extinguish any influence the financial advisor seeking expungement has over arbitrator choice. FINRA will simply randomly assign an arbitration panel. That means, the arbitrators tasked with deciding the case could have biases or conflicting interests to the broker. Nonetheless, the financial advisor will have no ability to remove them as a decisionmaker.

Financial advisors may still challenge arbitrators they believe keep biases or conflicts of interest for cause. But challenges to arbitrators for cause can come back to haunt those who make them, and rarely prove beneficial.

Key FINRA Expungement Rule Change 2– Brokers may not request removal of client grievance information if they already asked and lost.

This change applies to both straight-in requests, and requests made during an investor-initiated FINRA arbitration. In short, if a financial advisor has already sought expungement of the same customer complaint information, and lost, they cannot ask again.

Why it matters.

This change seems obvious. Currently, FINRA has supplied a notice that requires financial advisors to affirm that they have not pursued removal of a client disclosure. But technically, the current process makes it possible (though not likely) for a broker to pursue expungement of the same issue multiple times. But the FINRA rule changes end this possibility.

Key FINRA Expungement Rule Change 3– Financial advisors cannot pursue removal of a disclosure until after the investor arbitration concludes.

If an investor starts a formal lawsuit that leads to a disclosure on the broker’s record, the financial advisor must wait until that lawsuit concludes before he can file a straight-in request.

Additionally, if the investor names the financial advisor in a formal lawsuit, and the customer wins the FINRA arbitration, the advisor may not pursue expungement at all.

Why it matters.

These changes formalize procedures that parties with experienced counsel already honor. Financial advisors should (as a matter of course) wait until the underlying complaint concludes before pursuing expungement. Failure to wait creates confusion because the arbitration panel will have insufficient facts to rule on the merits of the broker’s argument for complaint removal.

A change that requires waiting, however, clarifies any uncertainty.

Similarly, financial advisors with experienced counsel should already avoid pursuing removal of a customer complaint that resulted in assigning liability to the broker through a winning FINRA arbitration. Indeed, such a result essentially eliminates the broker’s ability to meet the high standards to earn expungement under rule 2080.

Again, the new FINRA rules will eliminate any uncertainty on this issue.

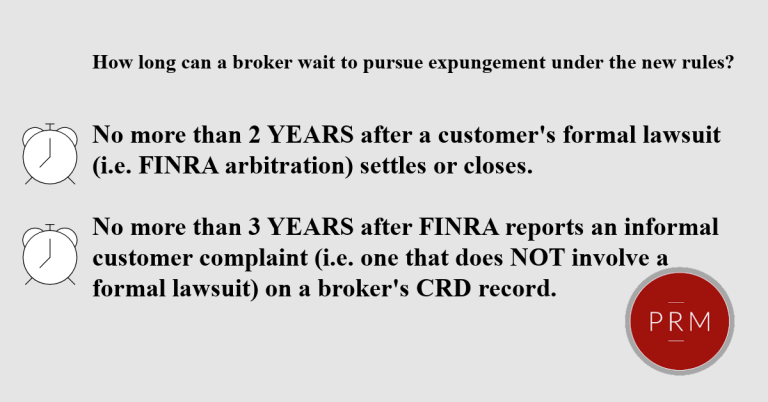

Key FINRA Expungement Rule Change 4– Time Limits

The new FINRA rules overhaul issues concerning the time limitation period within which a financial advisor may pursue expungement

- Straight-in requests involving a customer arbitration/civil litigation: 2 years after the customer arbitration/civil litigation closes

- Straight in requests that do not involve customer arbitration or litigation: three years from when the complaint is reported on the CRD system.

How will FINRA treat time limits for requests to remove customer complaint information that predate the effective date of the new rules?

Straight in requests that involve customer complaints that predate the effective date of the rule change:

- must be otherwise meet 6 year eligibility rule (which is not required currently);

- must made within 2 years of the proposed rule change if the complaint involved a customer arbitration or civil litigation; OR

- THREE YEARS of the proposed rule change if the complaint did not involve a customer arbitration or civil litigation.

Why it matters. How long can broker’s wait to pursue expungement under the new FINRA rules?

Presently, the time limits attributable to pursuing customer grievance information are ambiguous. This ambiguity has enabled brokers to pursue removal of dated customer complaint information. And in many instances, financial advisors have legitimate reasons for delays in pursuing removal of a disclosure.

Nonetheless, the new rules remove this ambiguity and supply clear time limits that financial advisors must pursue expungement.

Notably, brokers who have customer complaint information from more than 6 years ago will lose any opportunity to pursue removal of that complaint once the new rules take effect.

Key FINRA Expungement Rule Change 5– Customer Participation

Currently, advisors pursuing complaint removal must serve the complaining customer with notice of their attempt to clean their record. The requirement, however, is based on guidance and not on a formal rule. Additionally, the scope of the investor’s participation in the process remained ambiguous and at the discretion of the arbitrators.

That will change. The new rules will require brokers to supply notice to the investors and/or their counsel. They expressly allow customers to take part in the case as would any named party to the proceeding. The new FINRA rules allow customers to make opening and closing statements; present evidence; and cross-examine witnesses, among other things.

Why it matters.

Customer participation has been a primary focus of the new rules. Where arbitrators previously had discretion to dictate the scope of an investor’s participation in the proceeding, the new rules end that discretion.

Key FINRA Rule Change 6– Unanimous Decision Required

At present, brokers only need two out of three arbitrators to agree to grant expungement. That will change, and all arbitrators must unanimously agree to remove a complaint from BrokerCheck. (Please review our BrokerCheck “How-to” Guide for instruction on using this online tool).

Why it matters.

Requiring unanimity amongst the arbitration panel raises the financial advisor’s burden to win their expungement case to the “beyond a reasonable doubt” standard. This burden is analogous to the burden the prosecution must prove to convict criminals.

The unanimity requirement brings FINRA’s long-held position that removal of customer complaint information is an “extraordinary remedy.”

Key FINRA Expungement Rule Change 7– Expungement awards must provide a detailed explanation for the Panel’s rationale.

FINRA currently requires the arbitrators to supply a “brief” explanation for the basis for their decision to grant removal of a client complaint. The new rules, however, will remove the word “brief” from the rule language. The new rules will also require the panel to show specific documentary evidence or testimony on which they relied to justify the award.

Why it matters.

This change requires arbitrators to put in more effort in drafting their decisions to award expungement. The effort it takes to draft the contents of arbitration award (unfortunately) is significant. If arbitrators must work harder to grant expungement, it may suggest that they will be more reluctant to grant it.

Key FINRA Expungement Rule Change 8-Participation of state securities regulators.

To increase the chances that a broker’s expungement attempt receives opposition, FINRA will supply a mechanism to all a representative from any state securities regulator to take part in the expungement effort to oppose it. No rule presently allows intervention from any regulator in an expungement case.

Why it matters.

Allowing regulators to appear solely to oppose an expungement effort is the most notable key change to the process. State regulators will be able to cross examine witnesses and object to evidence. Regulators may not, however, seek discovery, file motions, or postpone the hearing.

State regulatory opposition creates an added obstacle to expungement. FINRA has not addressed how the hearing will continue if multiple state regulators wish to take part in a hearing.

The Bottom Line

Removing customer complaint information from BrokerCheck will become more difficult under the new rules. How these changes will work in practice is still and mystery. Similarly unknown is whether the FINRA rule changes will reduce the success rate of expungement cases.

Nevertheless, brokers with any inkling towards pursuing expungement of a customer complaint from BrokerCheck should do so before these changes to the expungement process take effect.

*The Law Offices of Patrick R. Mahoney is a full-service law firm with experience winning expungement cases. This page is for information purposes only and does not constitute legal advice; nor is it a comprehensive explanation of all forthcoming changes to the expungement process. If you would like to discuss your specific situation, please contact us.*